1. CONTEXT

1.1. Tourism Listed as one of Malawi’s Game-changers for Economic Growth

On 19 April 2024, His Excellency President Lazarus Chakwera launched the Agriculture, Tourism, Mining (ATM) strategy as a game-changer to boost domestic revenue and socio-economic growth. The Government identified these anchor sectors as having the potential to contribute to the country’s economic growth within the Malawi 2063 Development Agenda, particularly the Implementation Plan (MIP-1) for the first 10 years from 2021-2030. Later, Manufacturing was added in subsequent conferences, evolving the strategy to become ATMM. In line with the ATMM strategy, the Government, in the 2024/2025 National Budget, introduced a visa waiver to 79 countries to facilitate and ease the inflow of tourists into the country, among others. One key message in the ATMM strategy is that the tourism sector continues to perform below its potential due to obstacles caused by other sectors. In the 2025/26 budget, the government has demonstrated commitment to tourism development by allocating 17.970 billion Kwacha, an increase from K4.8 billion in the 2024/25 budget.

1.2. Tourism Sector Overview

Malawi is land-linked to three better-known and more developed international tourism destinations: Tanzania, Zambia, and Mozambique. The wider East and Southern Africa (ESA) region, within which Malawi sits, includes other countries with well-developed tourism sectors, notably, Kenya, Mauritius, Botswana, Namibia, and South Africa. Although Malawi has no single “must see,” internationally recognized attractions such as Victoria Falls, it does offer a rich combination of natural and artificial attractions due to its geography, history, heritage, and diverse ecological zones.

In Malawi, tourism is a relatively new phenomenon in national economic development planning. The country has been a predominantly agriculture-based economy since its independence in 1964. However, tourism remains a key potential sector in the development of Malawi. According to the Travel & Tourism Economic Impact 2024 report by the World Travel & Tourism Council (2023), 4.8 percent of total GDP contribution (US$647.0 million) was generated from the tourism sector. Malawi’s tourism revenue is projected to hit $260 million by 2028, up from approximately $220 million in 2023, representing an average annual increase of 2.7 percent. In the past decade, Malawi received an average of 800,000 visitors annually. It is estimated to increase to over 1.25 million visitors by 2029 if the tourism sector is nurtured sustainably. Out of the top 10 countries from which visitors frequent Malawi, about 75 percent of visitors are from within Africa.

1.3. 2024/2025 National Budget Statement

According to the 2024/2025 Budget Policy Statement, the sector contributes about 6.7 percent to GDP with the potential to contribute at least 11 percent to GDP by 2030. The Government made some key achievements in the industry, such as the construction of a School of Tourism at Mzuzu University with state-of-the-art facilities, among others. The Government allocated K4.8 billion, anchored by the 20-year National Tourism Investment Masterplan and a Domestic Tourism Marketing Strategy for the 2024/2025 fiscal year.

The Government is working to implement tourism reforms which include: (i) strengthening the legal framework to create an enabling environment for increased competitiveness of the sector; (ii) strengthening Tourism Institutional capacity to implement tourism and wildlife programmes; and (iii) enhancing revenue management through the automation of payments of the tourism levy, licensing fees, and gate entry fees.

Through the Department of Tourism, the government has initiated and coordinated the development, implementation and review of key legislative and strategic documents, including the National Tourism Policy, Tourism Strategy, Marketing Strategy and Tourism Master Plan. In addition, through the Marketing section within the Ministry, the Government is making an effort to enhance visibility of Malawi as a tourist destination both domestically and internationally.

1.4. Challenges Hindering Tourism Sector Growth

Malawi is challenged in embracing effective policies to enable public and private sector alignment to achieve a viable niche as an economically productive, multi-experience destination in its own right. Key constraints to the tourism sector include (i) climate change and adverse weather impacts including cyclones and floods; (ii) macroeconomic imbalance evidenced by rising fuel and food costs, high inflation rates, and forex scarcity; (iii) underdeveloped natural, cultural and man-made attractions; (iv) lack of effective cross-sectoral planning and implementation; (v) limited destination marketing initiatives in selected markets; (vi) limited supply of high-quality trained labour; (vii) inadequate supporting infrastructure and services (i.e. road, air, rail) and ticket prices; (viii) lack of seamless flights from regional hubs which are limited and costly; (ix) gaps in the regulatory and institutional framework; and (x) lack of coordinated efforts among private sector operators.

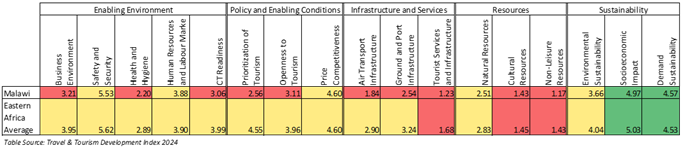

The Travel & Tourism Development Index (TTDI) 2024 evaluates the performance of 119 countries by assessing a set of factors and policies that enable the sustainable and resilient development of the sector, which in turn contributes to a country's overall development. Malawi is ranked 115 out of 119 countries with a score of 3.06 in TTDI 2024 (overall score range is from 1 to 7, where 1 = worst and 7 = best). Malawi’s overall performance is below average across 17 indicators (table below) that fall under five categories: (i) Enabling Environment; (ii) Policy and Enabling Conditions; (iii) Infrastructure and Services; (iv) Resources; (v) Sustainability. Malawi scored above average in only two sub-categories under Sustainability: Socioeconomic Impact and Demand Sustainability.

Table 1: Travel & Tourism Development Index (TTDI 2024)

1.5. Impact of COVID-19 on Malawi Tourism Sector

Malawi tourism was adversely affected by COVID-19 resulting in 30,000 jobs being cut. Moreover, the number of jobs created in the sector has also declined from 586,000 in 2019 to about 496,200 in 2022. Published data from the 2023 World Travel and Tourism Council (WTTC) Annual Research reports that the contribution of tourism to the GDP has continued to decline since 2019, falling from 7% to 5% in 2022. According to Treasury data, Malawi had a stable increase in international tourist arrivals, rising at an average rate of 5% annually from 2015 to 2019, but it dropped by over 50% in 2019.

2. POLICY AND LEGISLATIVE ENVIRONMENT

2.1. Tourism and Hotels Act (1968)

The Tourism and Hotels Act of 1968 [Amendment 2014] provides for the control and management of hotels, establishing a Tourism and Hotels Board and other matters. The Ministry of Tourism has been reviewing the outdated Tourism and Hotels Act of 1968 since July 2021. On 9th April 2025, Parliament passed the Tourism Industry Bill with a provision to establish a Tourism Authority to regulate and promote Malawi as a top tourist destination locally and internationally. The Bill also outlines the establishment of the College of Tourism, among other provisions.

2.2. Malawi Domestic Tourism Market Strategy (2018-2023)

The Malawi Domestic Tourism Market Strategy is a blueprint for promoting domestic tourism, which can catalyse the expansion of available economic opportunities through the development and collaboration of various public, private and non-government stakeholders.

2.3. National Tourism Policy (2019)

The National Tourism Policy outlined key challenges that hinder the full exploitation of the sector’s potential and provides possible remedies for addressing them. It presents six outcomes to be achieved through six policy priority areas and specifies institutional arrangements for its successful implementation.

2.4. Malawi National Investment Masterplan (2022-2042)

The Malawi National Investment Masterplan (MNTMP) is a 20-year roadmap that aims to create an enabling environment for the development, regulation, and promotion of a sustainable tourism sector that enhances tourist experience and satisfaction whilst improving the social-economic well-being and maintenance of the local cultural identity of local communities. The Tourism Master Plan identifies 103 tourism and infrastructure projects, the implementation of which will lead to the promotion and growth of the tourism sector in Malawi. In the plan, 10 projects are flagged by the Government of Malawi as priority tourism development projects. The Secondary Cities Project has identified eight new cities in the country.

3. DEVELOPMENT PARTNERS SUPPORT

3.1. Actions Taken in Supporting the Tourism Sector in Malawi

Development Partners (DP) have demonstrated a commitment to supporting the tourism sector through various projects. Total DP funding for the sector and related interventions is US$10.4 million. The table below presents the number of projects and key interventions as of 24 October 2024.

Table 2: Development Partners Commitment

| No. | Development Partner | Number of Projects | Total Estimated Funding (US$) |

|---|---|---|---|

| 1 | Deutsche Gesellschaft für Internationale Zusammenarbeit (GIZ) | 1 | 1,650,000.00 |

| 2 | European Union Delegation (EUD) | 1 | 8,780,800.00 |

| Totals | 2 | 10,430,800.00 | |

In 2021, the Government of the Republic of Malawi through the Ministry of Tourism, Culture and Wildlife received financing from the African Development Bank towards the cost of the support to the Promoting Investment and Competitiveness in Tourism Sector (PICTS) Project. Part of the funding was used to pay a consultancy firm to review the Malawi Tourism and Hotels Act (1968) and develop a new tourism law.

4. ROLLING TALKING POINTS (KEY MESSAGE FROM TIPDeP)

The Rolling Talking Points, by the Development Partners, aims to communicate key messages to the government, which includes applauding the government for undertaking regulatory reforms and asking it to address regulatory barriers and practices to accelerate sector performance.

4.1. APPLAUD

TIPDeP would like to applaud the Government for placing tourism in the Malawi 2063 and MIP-1 10-Year Implementation Plan as a priority economic sector under the Urbanization pillar towards accelerating the socio-economic transformation of tourist attraction sites. The Malawi 2063 aims to transform rural communities into cities, giving people opportunities to engage in ancillary services such as restaurants and tour guide services. The 10-Year Implementation Plan considers tourism as a tool towards supporting urbanization, which will be developed to contribute at least 11 percent to the GDP by 2030.

4.2 CONCERNS AND RECOMMENDATIONS

I. Legal Frameworks and Policies:

The Tourism Industry Act (Amendment – 2025) was approved by parliament on 9 April 2025. To ensure its effective implementation, the Government will need to accelerate the development and gazetting of the regulations of the Tourism Industry Act (amendment 2025), providing the establishment of the Malawi Tourism Authority (MTA), which will undertake operational activities in licensing, grading, and destination marketing. In addition, the Government should ensure that the process of developing regulations is done transparently with strategic thinking, informed analytical evidence, and long-term impact visioning. Currently, there is an opportunity for the Ministry of Tourism to invite various stakeholders to be involved in the Tourism Marketing Strategy and Action Plan (2022) review.

The Government is to swiftly establish the MTA to promote and regulate tourism investments. In countries such as Kenya and Tanzania, Tourism Ministries are dedicated to policy formulation and analysis, while public-private tourism boards handle cross-cutting policy and regulatory implementation. This approach has been successful in countries such as Tunisia, Mexico, and Mozambique.

The Government will need to support MTA’s capacity in terms of human capital, training and materials to function. Having capacity within the MTA is crucial for sustainable and effective tourism management. It enables planning for tourism growth, ensuring resource sustainability and participation of stakeholders in tourism decision-making. Adequate capacity of the MTA shall allow for investments in Malawi Tourism marketing campaigns, infrastructure development, and quality assurance programs, ultimately boosting tourism growth and economic benefits.

II. Road and Infrastructure Development:

Malawi's tourism sector, built on its natural assets like Lake Malawi and wildlife, requires continued investment, particularly in roads and infrastructure, to improve access and boost tourism development. Unfortunately, most roads and infrastructure have been badly degraded. Under the current situation, more urgency is needed in allocating government funds for roads and infrastructure development to the tourist attraction sites and hotels.

Creating access to Malawi’s natural assets, such as parks and reserves, requires continued investment in road development. Important domestic tourism roads should be prioritized in national decision-making, together with improvements to busy border post infrastructure and staffing.

III. Accessibility and Airfare Costs:

The tourism lab, facilitated by PDU, identified the high cost of air transport to Malawi and poor access options as major constraints for operators targeting international business and tourist visitors. Some of the reasons for high-cost airfares include excessive flight ticket taxes. According to the African Airlines Association (AFRAA), a leading trade association of airlines based in Ghana, the average amount paid in taxes and fees by passengers in Africa is more than twice what air travellers in other continents pay. Taxes and fees on African air tickets average $64; in Europe, it averages $30 per ticket.

Malawi is not exceptional in imposing high taxes in a quest to increase domestic revenue. Malawi's current taxation regime is not conducive to attracting foreign direct investment. Furthermore, Malawi has long been a signatory to the Yamoussoukro Declaration on open skies, but it has not implemented this as a policy. Although politically difficult, a solution that would enable a substantial increase in air access at a lower cost has to be found.

Currently, very few international airlines offer direct flights between Lilongwe and other cities, so tourists need to fly with one or more stopovers. The absence of direct flights leads to longer travel times, increased costs, reduced flexibility, and potential disruptions, as it necessitates connecting flights with layovers. This disadvantage reduces Malawi’s competitiveness as a tourist attraction destination. The Government will need to consider reducing landing fees and aviation fuel costs as well as developing infrastructure and security to attract international airlines, particularly those outside the African continent.

IV. Increase data gathering and analytical capacity to support decision-making:

Insufficient domestic data collection and limited ongoing analysis make it difficult for policymakers, development partners, and investors to determine the value of the sector and intervention priorities. As a result, increased data collection and analytical capacity are needed in key organizations that operate in and support the sector, i.e. the Ministry of Tourism, National Statistical Office (NSO), Tourism and Hotels Board (THB) or successor body, Mzuzu University, and private sector associations.