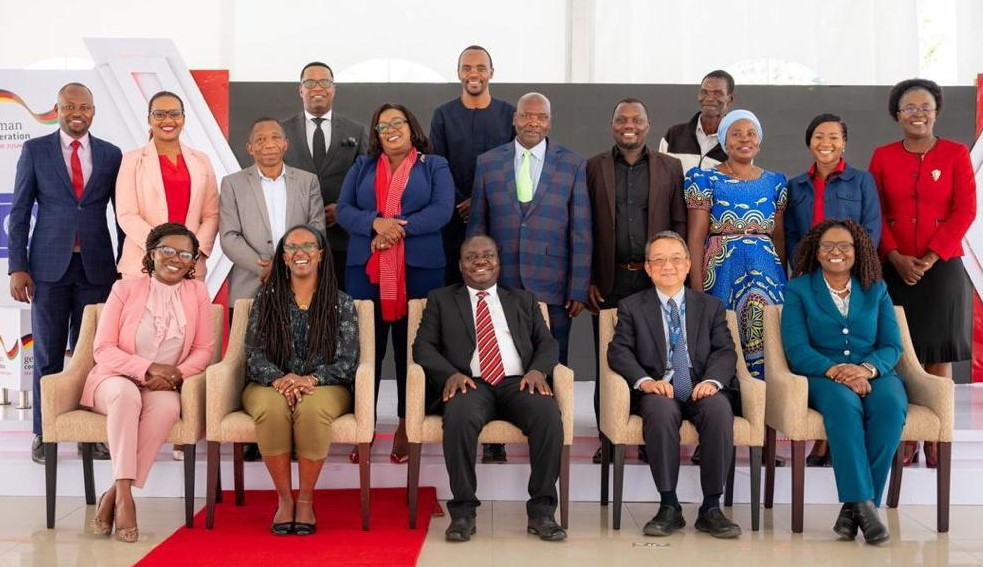

Trade, Industry and Private Sector Development Partners (TIPDeP) group demonstrated a landmark in harmonization through a joint launch of Finance products in partnership with the NBS Bank Plc. On 30 June 2023, NBS Bank Plc organized a joint launch of a Credit Scoring facility supported by the UNDP and an Agricultural Finance Product tailored for value chain actors in the Aquaculture value chain supported by the German Development Cooperation (GDC). Present to the colourful launch included the Principal Secretary for Agriculture, the UN Resident Representative to Malawi, a representative from the Embassy of German, the Chairperson of TIPDeP from USAID, the Director from the Ministry of Finance and Economic Affairs, the Deputy CEO of NBS Bank Plc and representatives from various Small and Medium Enterprises (SMEs).

Speaking at the event, the representative from the Embassy of German, Mrs. Carolyn Kanjala, underscored that GDC is motivated to support the tailor-made aquaculture finance product to accelerate the revolution of how farmers operate and invest in technology.

The UN Resident Representative, Shigeki Komatsubara, applauded GIZ, UNDP and TIPDeP in general for demonstrating a commitment to coordination in working with financial institutions such as NBS Bank Plc. He pointed out that supporting access to finance is vital for economic growth and attaining the Mw2063 ambitions because it is ranked as one of the top five barriers to doing business in Malawi. He applauded NBS Bank Plc for adopting the credit scoring facility which will help to reduce risks in lending to the SMEs.

The Deputy Chief Executive Officer of NBS Bank Plc, Mrs. Temwanani Simwaka, proudly underscored that NBS Bank Plc is a local bank, therefore, motivated to find solutions for Malawian SMEs. She pointed out that partnership with Development Partners especially GDC has been a milestone for the NBS Bank Plc to understand the aquaculture business and swiftly adopt the finance product for SMEs in aquaculture.

In his official opening remarks, the Principal Secretary for Agriculture responsible for irrigation, Engineer Geoffrey Mamba, pointed out that the Ministry is pleased to see growing partnerships in supporting the agriculture sector, a case of the NBS Bank Plc, GIZ and UNDP joint launch of finance facilities. He underscored that Government is committed to providing the enabling business environment and infrastructure for business growth. It is therefore the anticipation of the government to spur growing private sector investment and diversity in value chains. He urged financial institutions to expand their Agri-financial products to non-traditional value chains.

The TIPDeP Chair, Mrs. Eluphy Nyirenda, was one of three panellists and she focused on the role of Development Partners in supporting SMEs in access to finance. In her submission, she underscored the need for the Government to ensure the creation of a favourable business environment. Furthermore, she encouraged the SMEs to be proactive and innovative to swiftly access the available finance products. She then urged NBS Bank Plc to ensure that the launched finance products are rolled out. In her conclusion, she re-committed the DPs’ support in de-risking credit facilities to SMEs.